What Is The Best THCA Flowers For Relaxation And Sleep

Discovering The Best Thca Flowers For Relaxation And Sleep

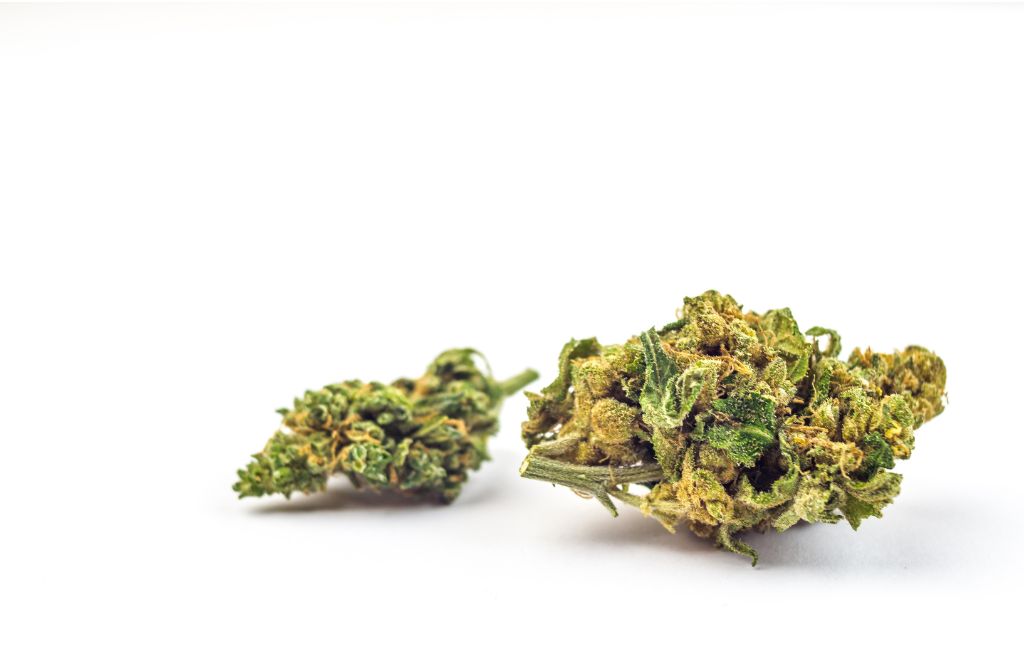

Best THCA Flowers In recent years, there has been actually a rise in advantage neighboring the possible restorative perks of cannabinoids, particularly Tetrahydrocannabinolic Acid (THCA). As the non-intoxicating prototype to THC, THCA is obtaining interest for its possible to use leisure and aid in sleeping. With an assortment of marijuana tensions offered, selecting the best THCA blossom for relaxation and sleeping may be discouraging. In this short article, we’ll examine the features of several of the greatest THCA flower petals for promoting relaxation as well as boosting sleeping high quality.

Knowing THCA

THCA is a naturally taking place compound discovered in uncooked cannabis vegetations. Unlike THC, THCA is non-intoxicating and have to be actually decarboxylated (hot) to convert into THC, the psychedelic compound responsible for the “higher” associated with cannabis usage. Nevertheless, research study suggests that THCA has its own curative properties, featuring anti-inflammatory, neuroprotective, as well as anti-emetic results.

Picking The Best THCA Flowers

When picking THCA blossoms for leisure and sleeping, it’s essential to take into consideration different factors, consisting of terpene profile, cannabinoid content, and specific level of sensitivity to different strains. Right here are some pressures renowned for their comforting effects:

Grandfather Purple

Grandfather Purple, an indica-dominant strain, is actually treasured for its strong leisure buildings. With extreme levels of THCA and also myrcene, a terpene known for its own tranquillizing results, Granddaddy Purple is actually frequently suggested for evening usage to unwind and ensure peaceful sleep.

North Lights

North Lights is actually a classic indica tension celebrated for its own capacity to induce strong leisure as well as reduce sleeping disorders. Rich in THCA as well as featuring an unique down-to-earth and sweet smell, Northern Lights is chosen through a lot of for its own comforting results on both the mind and body.

ACDC

For those seeking relaxation without the envigorating impacts normally associated with THC-rich tensions, ACDC offers an appealing answer. This high-CBD, low-THCA stress is renowned for its anxiolytic residential or commercial properties, making it an outstanding choice for individuals sensitive to THC or even those seeking remedy for anxiety as well as worry.

Bubba Kush

Bubba Kush is actually an indica pressure respected for its own strong sedative effects and also capability to induce a feeling of rich relaxation. With extreme degrees of THCA and also an one-of-a-kind blend of terpenes, featuring caryophyllene as well as limonene, Bubba Kush is a preferred selection for those finding relief from sleep problems as well as muscle mass pressure.

Purple Punch

Violet Punch is actually an indica-leaning crossbreed understood for its own delightful, fruity smell and also highly effective enjoyable effects. Along with a THCA-rich profile as well as a combination of terpenes such as myrcene and caryophyllene, Purple Punch is usually highly recommended for evening make use of to loosen up and advertise sleeping.

Introducing The Therapeutic Potential Of Thca Flowers For Relaxation And Sleep Enhancement

In the realm of all-natural solutions, cannabinoids have actually become promising candidates for promoting leisure and boosting sleeping high quality. Tetrahydrocannabinolic Acid (THCA), a forerunner to THC, has achieved focus for its own non-intoxicating residential or commercial properties as well as possible curative advantages. As enthusiasm in marijuana continues to develop, checking out the greatest THCA flower petals for relaxation and sleep ends up being increasingly pertinent. This short article strives to dig deeper in to the curative possibility of THCA blossoms and highlight some popular pressures renowned for their relaxing effects.

The Therapeutic Potential Of THCA

THCA, bountiful in raw cannabis vegetations, provides a myriad of possible healing results. While study on THCA is still in its infancy, preliminary studies recommend that it may possess anti-inflammatory, neuroprotective, and also anti-emetic buildings. Furthermore, anecdotal evidence suggests that THCA may add to relaxation and also rest enlargement without the psychedelic impacts related to THC. By using the healing possibility of THCA, individuals can easily discover all-natural options to conventional sleeping help and also leisure approaches.

Discovering THCA-Rich Strains

When looking for THCA blooms for leisure and also rest enhancement, it’s essential to take into consideration elements like cannabinoid web content, terpene profile, and individual choices. Listed below are some notable THCA-rich stress recognized for their soothing effects:

Blue Dream

Blue Dream is a sativa-dominant hybrid celebrated for its own balanced effects as well as uplifting high qualities. While mostly recognized for its high THC web content, Blue Dream also has substantial levels of THCA, making it a functional possibility for relaxation as well as tension comfort. Along with a wonderful, berry-like smell as well as delicate smart impacts, Blue Dream agrees with for daytime use or relaxing at night without generating sleep or sedation.

Cherry Wine

Cherry Wine is a CBD-dominant pressure appreciated for its calming homes as well as very little psychoactive results. With reduced degrees of THC and superior concentrations of THCA as well as CBD, Cherry Wine delivers a gentle strategy to leisure and also sleep enhancement. Ideal for individuals seeking remedy for stress or pain without intoxication, Cherry Wine markets a sense of tranquility as well as calmness.

Buffoon

Buffoon is a sativa-dominant crossbreed renowned for its own well balanced cannabinoid account and uplifting impacts. Featuring very high levels of THCA as well as CBD, Harlequin gives a distinct combo of relaxation as well as psychological clarity. With a spicy, earthy smell as well as understated bliss, Harlequin is favored by lots of for alleviating anxiety and also advertising relaxed rest without harming cognitive feature.

Treatment

Treatment is actually an indica-dominant pressure prized for its potent curative homes and also tranquillizing impacts. Along with high levels of THCA and CBD, Remedy offers a mild however, efficient remedy for relaxation and also rest augmentation. Known for its natural, woody fragrance and soothing effect, Remedy is excellent for evening usage or taking a break after a long time.

Final Thought

Incorporating THCA-rich cannabis florals in to your well-being schedule may supply an all-natural service for leisure and also improving rest top quality. Having said that, it is actually important to bear in mind that private knowledge may vary, as well as talking to a healthcare professional is recommended, specifically for those along with underlying wellness disorders or problems. By looking into tensions like Granddaddy Purple, Northern Lights, ACDC, Bubba Kush, as well as Purple Punch, individuals may find out the best THCA blooms satisfied to their unique requirements and choices, breaking the ice for an even more relaxing and invigorating evening’s sleep.